SEO Opportunities During the Corona Outbreak

COVID 19 is a big deal.

We all feel it, and it is just starting. It is going to get a lot worse.

With all the grief and fear, we need to get out stuff together, and find a strategy to navigate our business in these hard times.

The good news I want to share with you, is that such a major event will offer plenty of opportunities for our businesses. I will show those opportunities.

Where is This Going To

Like in any situation, first thing is to gather information and asses what is ahead of us.

Let’s look

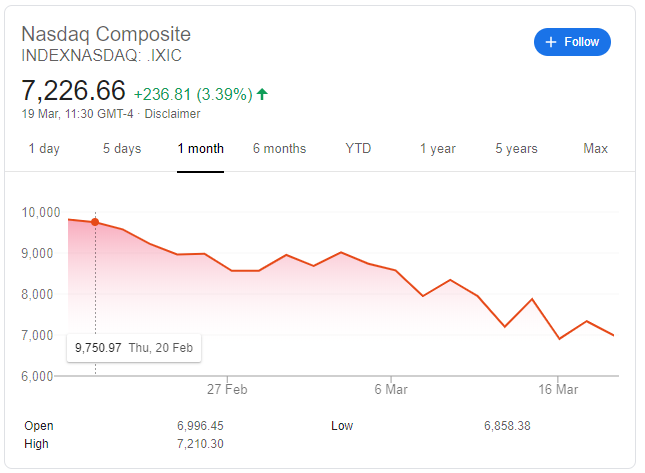

at the stock market

Roughly, 30% lost in one month.

Will it get better?

Yes, but not before it will get a lot worse.

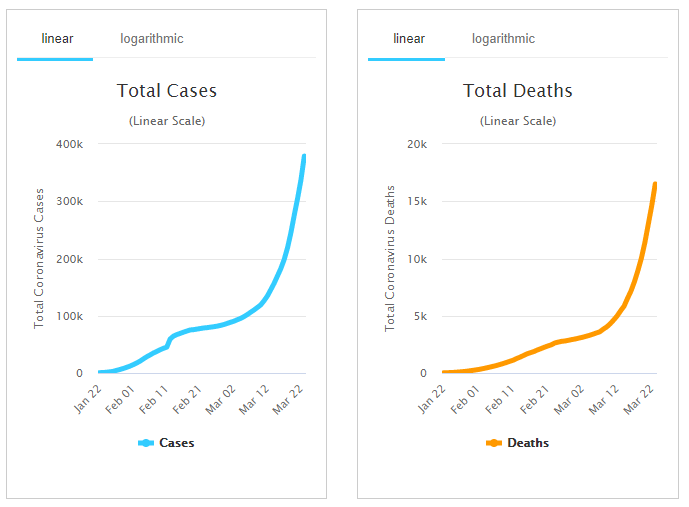

Here are the numbers of active Corona cases and deaths

Look at these curves. This is not getting any better. This is just starting!

We don’t know what will be the final numbers. But it seems that a big part of our population will get the virus this time or another. The market will suffer during this time.

Now for the Good News

It will end! This is not the end of the world.

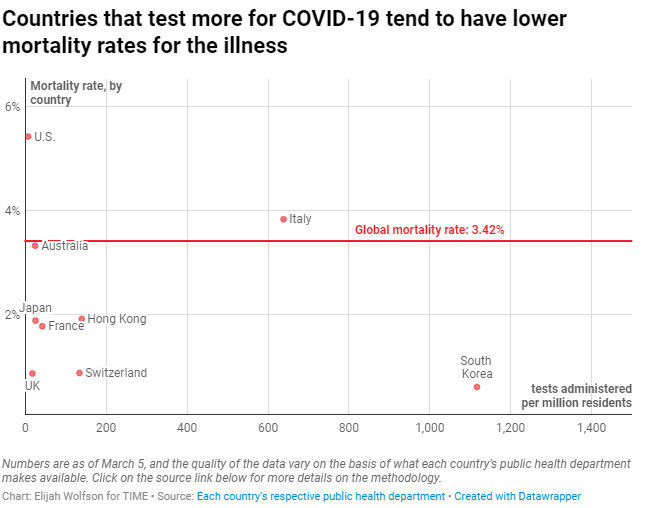

The virus only kills small percentage of the population. If you look at countries that test more of the population, like South Korea and Germany, you see that the mortality rate is around 0.61%. Ignore the rates from Italy and US, they are simply because of lack of testing. See the chart from Time Magazine:

So, with all the sadness, more than 99% of population will survive, and the market will go up again!

It is just a matter of time until this happens.

You should adjust your business to these difficult times and prepare for opportunities that will arise from the horrible situation.

Don’t get scared. Act on time and you’ll go out of this stronger than ever. Let me show you how.

The Strategy

The goal is to cut efforts that won’t work in these times and to increase the efforts that will produce assets. Those assets will yield profits when this situation ends.

In short, we will cut down on anything that serves us in the short term and focus on the long term. We give up trying to earn in the short term, and we want to build our position for the good days to come.

First, let’s see what activities we can decrease now.

Remember this is only temporary.

Here are some ideas that can work to reduce your monthly spend and efforts:

- Reduce your staff – if you pay monthly for work to support your clients, that could be reduced in this time. Your clients will drop anyway now as this situation keeps progressing.

- Reduce the paid advertising – If you paid 7% of your income for advertising, try something like 2%-3%.

- Decrease your rent. Even cancel it if you work from home. Or, at least use the situation to get a better deal. Yes, same as the renter used the good times to increase the rent, now it is you who has the upper hand.

- Don’t chase after clients – these are futile efforts. They’ll come when the COVID 19 situation ends. Just make sure you’ll be ready for them with the best service when the time comes.

OK, now that you have cut down on those efforts, let’s see our opportunities in this time.

You should now have more time and hopefully more money if you found how to cut things.

Now, we want to concentrate on building our business for the days to come.

Like a captain of a sailboat, we are preparing for the wind that will come. The wind is the economic recovery that will happen once this COVID 19 ends. Currently, we don’t have any wind, so we take down our sail and improve it. It might look like nothing happens now, but once our sail is ready, and the wind comes it will take us faster than ever. I hope the metaphor makes sense; I tried my best.

We need to focus on building assets. You might find them useless today, but they will serve you in the future.

SEO is the perfect asset for your business. If you build it now, you’ll promote yourself in the rankings and when the economy improves, you’ll get the business you deserve.

Here are a few examples of assets I suggest. I will focus on SEO here:

- Build backlinks – they should be cheaper these days. Businesses are not spending much and the bloggers and other site owners will be happy to get your money and provide you with a good backlink. That could be a review of your business, a mention of your business, a comparison of your service to other services. Whatever. Just keep building the backlinks.

- Build content – search engines love good content. You can now write some posts on your blog, hire a content writer in less money than usual. Do videos on YouTube. Create infographics. Add images.

- Improve your conversion rate – it is a good time to test your site. Do some A/B testing. The better your conversion rate, the better your results will be when the visitors will come.

- Fix the technical SEO issues – look at your SEO audit and fix the issues there.

- Improve your UI – a designer would love to get work in this time, and the cost might be half than it used to be.

- Make you website responsive – if you didn’t already. Yes, people will keep using their mobile.

I said these are opportunities now because the slow market should make things cheaper.

Don’t feel bad about exploiting the situation to your favour. Even if you are paying half of the normal price, you still help people get paid in tough times.

Learn from the Pros

Rough times are great for business.

Sounds weird right?

But smart people always did that.

Warren Buffet said, “A simple rule dictates my buying: Be fearful when others are greedy and be greedy when others are fearful”. See here: https://www.cnbc.com/2018/09/14/warren-buffetts-rule-for-investing-during-the-financial-crisis.html

In 2008, in the credit crisis, he bought tons of stocks!

If you invested $1,000 in Apple in early August 2008, it would have been worth more than $26,000 as of Jan 17, 2020.

Corporations like Blackstone used the 2008 crisis to buy thousands of properties worldwide.

If you’re like me, some of our assets are online, and this is a great time to invest!

Conclusion

These are my thoughts, what do you think?